Why Homeownership Builds Wealth: Understanding the Homeowner Vs. Renter Equity Gap

- yourrealestateangel

- Nov 19, 2024

- 2 min read

Have you ever wondered why homeowners consistently have a higher net worth than renters? The difference lies in equity—a powerful wealth-building tool that renters simply don’t have access to. Let’s break down why owning a home can transform your financial future.

What Is Equity?

Equity is the portion of a home that you own outright. It grows over time in two primary ways:

Paying Down Your Mortgage: Each payment reduces the loan balance, increasing your stake in the property.

Appreciation: As home values rise, the value of your investment grows.

For renters, monthly payments only go toward covering living costs, without building ownership in an asset.

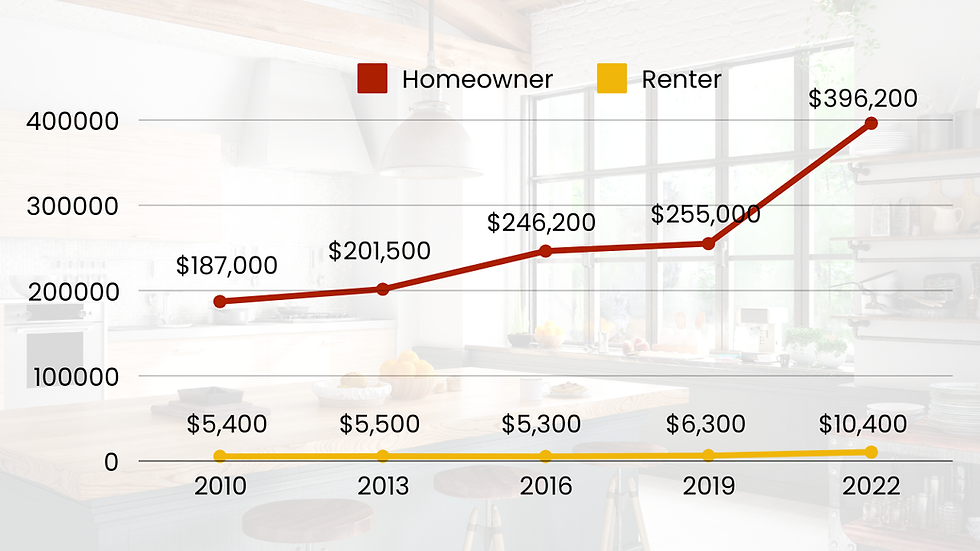

The Net Worth Gap: By the Numbers

On average, a homeowner’s net worth is nearly 40 times higher than that of a renter. This gap continues to grow as home values increase.

For example:

In 2010, the average homeowner had a net worth of $187,000, compared to just $5,400 for renters.

By 2022, homeowners saw their average wealth skyrocket to $396,200, while renters increased only slightly to $10,400.

This disparity demonstrates how homeownership acts as a long-term financial strategy for wealth accumulation.

Why the Gap Is Growing

A key reason for the widening gap is the appreciation of home values over time. When you own a home, you benefit from the rising real estate market, which increases your equity. In contrast, renters miss out on this growth because they don’t own the property.

Additionally, homeownership offers stability. Mortgage payments often remain fixed, while rent tends to rise annually, further limiting renters’ ability to save or invest.

What This Means for You

If you’re renting now, consider the financial advantages of owning. More inventory in today’s market may make it easier to find a home that fits your budget. And with slower price growth in some areas, you may have an opportunity to enter the market without as much competition.

For current homeowners, staying invested in your property continues to build your wealth, especially as your home appreciates.

Building Your Financial Future

Whether you're currently renting or owning, understanding the wealth-building potential of homeownership is crucial. Owning a home doesn’t just provide a place to live; it’s a long-term strategy for financial growth.

If you’re ready to explore homeownership, now may be the perfect time. Let’s connect to discuss how you can begin building equity and closing the net worth gap today.

Comments